Home Insurance for Strata Properties in Australia: Your Ultimate Guide to Coverage

Bloggerbanyumas.com – When it comes to owning or renting strata properties in Australia, one of the most important investments you can make is securing the right home insurance. Whether you’re a strata property owner, a tenant, or an investor, understanding the ins and outs of strata insurance is crucial to ensure that your property, belongings, and financial interests are adequately protected.

Strata properties present unique challenges and opportunities when it comes to home insurance. With the shared responsibility between individual owners and the strata scheme, navigating the complexities of strata insurance policies can seem daunting. However, with the right knowledge, you can find the coverage that best suits your needs and budget, and safeguard your investment from unexpected damages, accidents, or natural disasters.

In this comprehensive guide, we will explore the essentials of strata property insurance in Australia, how it works, what it covers, and how to choose the best policy for your situation. Whether you’re living in a townhouse, apartment, or any other type of strata-managed property, this guide will equip you with the knowledge to make informed decisions.

What Is Strata Insurance and Why Is It Important?

Strata insurance is designed specifically for properties that are part of a strata scheme, where multiple owners share common areas such as hallways, roofs, and gardens. It is an essential policy for any property within a strata-managed building or complex, as it covers both the individual unit and the shared areas that are jointly owned.

The primary purpose of strata insurance is to protect the structure of the building, communal areas, and in some cases, the individual units, from damages caused by accidents, fire, storms, theft, and other unexpected events. It also provides liability coverage for accidents or injuries that occur within the common areas of the strata property.

In Australia, the legislation governing strata insurance may vary from state to state, but it is generally required that the owners’ corporation (or strata management) maintain insurance for the property’s structure and common areas. Individual owners may also need to secure separate insurance for their unit’s contents and any alterations made to their property.

Key Components of Strata Insurance

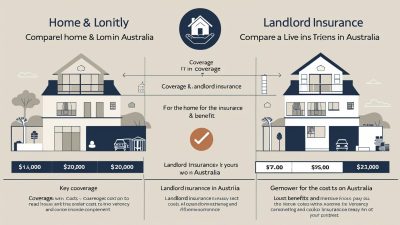

Strata insurance can be divided into two main types: Building Insurance and Contents Insurance. While building insurance is typically the responsibility of the owners’ corporation, contents insurance is usually the responsibility of the individual unit owners. Understanding these components is key to ensuring that both the building and your personal property are adequately covered.

1. Building Insurance for Strata Properties

Building insurance covers the physical structure of the property, including the walls, ceilings, floors, roofs, windows, and common areas like corridors, lifts, and gardens. This type of insurance protects against damages caused by fire, storms, vandalism, or other unforeseen events. The responsibility for maintaining building insurance typically falls on the owners’ corporation (also known as the strata company or body corporate).

Building insurance for strata properties is often bundled into the strata levies paid by the owners. It is essential that the owners’ corporation ensures that building insurance is in place to cover repairs and rebuilding costs in the event of a disaster.

2. Contents Insurance for Strata Properties

Contents insurance, on the other hand, covers the personal belongings inside each unit. This includes furniture, electronics, appliances, clothing, and other valuables that are not part of the building’s structure. As a unit owner, it is your responsibility to arrange contents insurance for your personal items, as building insurance only covers the common areas and the structural elements of the property.

Some strata owners also opt for additional coverage for any improvements or alterations they have made to their unit, such as renovating a kitchen or bathroom. It’s important to note that contents insurance does not cover damage to the building structure, so you’ll need a separate policy for that.

3. Public Liability Insurance for Strata Properties

Public liability insurance protects the owners’ corporation and individual owners from legal claims or lawsuits arising from accidents or injuries that occur in common areas of the strata property. This is an essential coverage for strata properties with shared spaces, as it can help cover medical bills, legal costs, and damages resulting from accidents in communal areas.

This insurance is usually included in the strata insurance policy and is required by law in most states across Australia.

How to Choose the Best Home Insurance for Strata Properties in Australia

Choosing the right home insurance for your strata property can be a complex process, especially with multiple parties involved. Below are key factors to consider when selecting an insurance policy for your strata property, whether you’re an owner or a tenant.

1. Understand Your Coverage Needs

Before purchasing any insurance policy, it’s essential to understand what you need to be covered. In a strata property, the owners’ corporation typically handles the building insurance for the shared areas, but you will need separate coverage for your unit’s contents. However, there are instances where additional coverage is required for improvements or alterations made to your unit. For example, if you’ve renovated your kitchen or installed expensive flooring, you may want to extend your contents insurance to cover these specific items.

2. Review Your Strata Scheme’s Insurance Policy

The owners’ corporation is required to maintain insurance for the shared parts of the property. As a unit owner, you should request a copy of the strata scheme’s insurance policy to ensure that it covers everything that it should. Review the policy for exclusions, the coverage limits, and the excess amounts to make sure it is sufficient for the needs of your building.

If the building insurance covers only the basic requirements, you may need to supplement it with additional coverage for things like flooding, accidental damage, or other potential risks specific to your area.

3. Look for Insurance Providers with Strata Experience

Choosing an insurer that specializes in strata properties is crucial to ensure that you receive the right coverage and support. Strata insurance is different from standard home insurance, and a provider with experience in this field will be able to guide you through the complexities of your policy, ensuring you’re properly protected.

Look for insurers who understand the unique nature of strata properties and who offer tailored policies that cover the specific risks associated with shared living environments.

4. Check for Discounts and Multi-Policy Offers

Many insurers offer discounts for bundling multiple policies, such as combining your contents insurance with your car or landlord insurance. Some insurers also provide discounts for property owners who have implemented security measures or who haven’t made a claim in several years. Take advantage of these offers to reduce the overall cost of your premiums.

5. Compare Quotes from Multiple Insurers

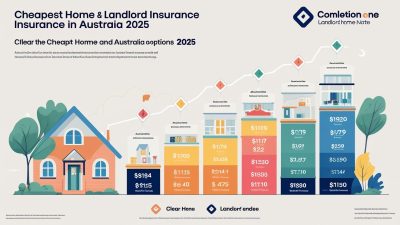

Like any insurance product, it’s important to shop around and compare quotes from multiple insurers. Prices can vary significantly, so obtaining multiple quotes will help you find the best deal that suits your coverage needs and budget. Online comparison websites make this process easy and efficient, allowing you to compare policy features, premiums, and excess amounts across different providers.

6. Understand the Policy’s Exclusions

Strata insurance policies typically come with certain exclusions that limit the coverage provided. Common exclusions include damage caused by wear and tear, negligence, or deliberate acts. It’s essential to review the fine print of the policy and understand these exclusions before signing any agreement. Knowing what is not covered can help you avoid unexpected costs and ensure you make the right insurance choice.

7. Regularly Review and Update Your Insurance Policy

As with any insurance policy, it’s important to regularly review and update your strata insurance coverage. Changes in your property, such as renovations or new appliances, may require adjustments to your policy. Additionally, if the strata scheme’s insurance policy changes, ensure that you are still adequately covered for the common areas.

Top Insurers for Strata Properties in Australia

Several insurance companies specialize in strata insurance and offer comprehensive policies tailored to the unique needs of property owners in strata schemes. Below are some of the top insurers that provide home insurance for strata properties in Australia:

1. QBE Insurance

QBE is a well-known Australian insurer that offers a range of strata insurance products. Their policies cover building and contents insurance, as well as liability protection for shared areas. QBE is known for its reliable customer service and comprehensive coverage options.

2. NRMA Insurance

NRMA offers strata insurance tailored to the needs of property owners in shared living environments. Their policies cover the building structure, common areas, and contents insurance for individual units. NRMA also provides liability coverage for common areas and legal protection for accidents that occur in shared spaces.

3. Allianz Insurance

Allianz is a trusted name in the Australian insurance market, offering both building and contents insurance for strata properties. Their policies are customizable, allowing you to add extra coverage for specific risks, including flood and accidental damage. Allianz also provides public liability insurance for strata properties.

4. GIO Insurance

GIO offers flexible strata insurance policies that cover building damage, common areas, and liability claims. GIO also provides additional coverage for contents insurance, which can be tailored to suit the individual needs of unit owners.

5. Suncorp Insurance

Suncorp provides a range of insurance products for strata properties, offering both building and contents coverage. Their policies include options for additional protection against specific risks, such as storm damage and fire, making them a popular choice for strata property owners.

Conclusion

Securing the right home insurance for your strata property in Australia is essential to protect both your individual unit and the shared areas of your building. By understanding the key components of strata insurance, reviewing your coverage needs, and comparing quotes from different providers, you can ensure that you’re getting the best deal on comprehensive coverage.

Remember to regularly review and update your policy as your property and the strata scheme’s insurance needs evolve. With the right strata insurance, you can safeguard your investment and have peace of mind knowing that you’re fully protected against a wide range of risks. Start exploring your options today to find the best home insurance for your strata property in Australia.