Cheapest Home Insurance Brisbane: The Ultimate Guide to Affordable Coverage

Bloggerbanyumas.com – Cheapest Home Insurance Brisbane When it comes to securing your home, obtaining the right home insurance policy is crucial. Home insurance protects not only your property but also your peace of mind. However, finding affordable coverage without sacrificing quality can be a daunting task, especially in a competitive market like Brisbane. This comprehensive guide will help you navigate the complexities of the home insurance market, highlighting the factors that influence your premiums and providing practical tips on how to secure the cheapest home insurance in Brisbane.

Home insurance in Brisbane is available in various forms, each tailored to meet different needs and budgets. Whether you’re a first-time buyer, a property investor, or looking to update your current policy, understanding your options and making informed decisions is the key to ensuring both affordability and comprehensive coverage. Let’s dive into the essentials of home insurance in Brisbane, and how you can save on premiums while ensuring your property is fully protected.

What Influences Home Insurance Premiums in Brisbane?

Before diving into the cheapest options available, it’s essential to understand what determines the cost of home insurance in Brisbane. The premium you pay is affected by several factors, some of which may be within your control, while others are determined by external influences.

1. Property Value and Location

The value of your home and its location in Brisbane are two of the most significant factors impacting your premium. Homes located in areas prone to natural disasters, such as floods or storms, may have higher premiums. In contrast, homes situated in low-risk zones typically enjoy lower premiums. Additionally, properties with higher market values or expensive rebuild costs generally result in higher insurance premiums.

2. Building Materials and Age of the Home

The materials used in the construction of your home also play a role in determining your premium. Homes built with fire-resistant materials or structures that are more resilient to storms may result in lower premiums. On the other hand, older homes that may require more maintenance or are built with less durable materials may have higher insurance costs.

3. Level of Coverage

The type of coverage you choose for your home insurance policy directly influences the premium. Comprehensive home insurance policies that cover both the structure and contents of your home are generally more expensive than basic building-only policies. The level of excess you’re willing to pay also impacts the cost; higher excesses often lead to lower premiums.

4. Claims History

If you have a history of making frequent claims, insurers may view you as a higher risk, resulting in higher premiums. On the other hand, if you’ve maintained a clean claims history, you may be eligible for discounts.

5. Security Features

Homes with additional security features such as alarm systems, deadlocks, or surveillance cameras can often receive discounts on their home insurance premiums. Insurers see these features as reducing the likelihood of theft or damage, and in turn, reward homeowners with lower premiums.

6. Your Personal Details

Insurers will also consider your personal details, such as your age, occupation, and any previous insurance claims. If you’re considered a responsible homeowner, you may receive a discount. First-time homeowners, however, might face slightly higher premiums due to a lack of experience with property insurance.

How to Get the Cheapest Home Insurance in Brisbane

Now that we’ve outlined the factors that influence the cost of home insurance premiums, let’s look at specific strategies for obtaining the cheapest home insurance in Brisbane without compromising on coverage.

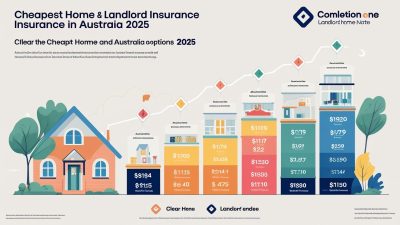

1. Compare Quotes from Multiple Insurers

The first and most effective step in finding affordable home insurance is to compare quotes from various insurance providers. Premiums can vary significantly between insurers, so obtaining several quotes gives you the opportunity to choose the best deal. Many comparison websites allow you to compare home insurance rates from leading providers in a matter of minutes. Be sure to compare not only the price but also the level of coverage, exclusions, and any optional extras included in the policy.

2. Adjust Your Excess

One of the most straightforward ways to reduce your premium is by increasing your excess, which is the amount you pay out-of-pocket in the event of a claim. By agreeing to pay a higher excess, you reduce the insurer’s risk, and in return, they offer you a lower premium. However, ensure that the excess is an amount you can comfortably afford if you need to make a claim.

3. Bundle Your Policies

Many insurers offer discounts for bundling multiple insurance policies. For example, if you have car insurance and home insurance with the same provider, you may be able to secure a multi-policy discount. This can result in significant savings, especially for families who require various types of coverage.

4. Review Your Coverage Regularly

It’s essential to review your home insurance policy regularly to ensure that you’re not overpaying for unnecessary coverage. For example, if you’ve made improvements to your home, such as adding a swimming pool or building a shed, these changes may require adjusting your coverage. On the other hand, if you’ve made repairs or removed high-value items, you could potentially lower your coverage and save on your premiums.

5. Improve Your Home’s Security

As mentioned earlier, homes equipped with advanced security features are viewed as lower-risk by insurers, which can translate to cheaper premiums. Installing security alarms, smoke detectors, and CCTV cameras can lead to substantial discounts. Additionally, ensuring your home is well-maintained and free from potential hazards can further reduce the likelihood of claims.

6. Opt for a Policy with Limited Extras

While comprehensive home insurance policies with numerous extras may seem appealing, they can quickly drive up the cost of your premiums. If you’re looking for the cheapest home insurance, consider opting for a basic policy that covers only the essentials, such as building damage and third-party liability. You can always add extra coverage later if needed, but keeping the initial policy simple can help reduce costs.

7. Maintain a Good Credit Score

In Australia, some insurers consider your credit score when calculating home insurance premiums. A good credit score indicates that you’re a reliable borrower, which may result in lower premiums. If your credit score needs improvement, work on managing your finances responsibly by paying bills on time and reducing outstanding debts.

8. Take Advantage of Discounts

Insurance providers often offer various discounts that can significantly lower your premiums. Some discounts may be based on your home’s age, your claims history, or even your occupation. Make sure to inquire about available discounts when obtaining a quote, as some may not be immediately obvious.

Common Home Insurance Mistakes to Avoid

While seeking the cheapest home insurance in Brisbane, it’s crucial to avoid certain common pitfalls that could ultimately cost you more in the long run. These include:

1. Underinsuring Your Home

While cutting corners to save on premiums is important, underinsuring your home is a serious mistake. If you don’t have adequate coverage, you may find yourself out-of-pocket when it comes to making a claim. Always ensure that the sum insured reflects the true cost of rebuilding your home and replacing your contents.

2. Ignoring Exclusions and Conditions

Every home insurance policy has its exclusions, which outline the situations or events not covered by your insurance. Make sure you read the fine print carefully to understand these exclusions. For instance, flood damage may not be covered under standard policies in Brisbane, requiring a separate flood insurance policy.

3. Failing to Update Your Policy

As your life circumstances change, so should your insurance policy. If you make renovations, acquire valuable items, or change the way you use your property, make sure to update your policy to reflect these changes. Failure to do so could result in inadequate coverage or a higher premium than necessary.

Conclusion: Finding the Best Value for Home Insurance in Brisbane

Home insurance is an essential investment in protecting your property, but it doesn’t have to break the bank. By understanding the factors that affect your premiums, making adjustments where possible, and comparing different policies, you can find the cheapest home insurance in Brisbane that offers comprehensive coverage for your needs. Remember to regularly review your policy and make adjustments as your circumstances evolve. With these tips and strategies in mind, you’ll be well on your way to securing affordable home insurance that provides peace of mind without sacrificing quality.