Cheapest Home Insurance in Melbourne: A Comprehensive Guide to Securing Your Property

Bloggerbanyumas.com – When it comes to protecting your home, securing affordable home insurance is a key priority. Whether you’re a first-time buyer or a seasoned homeowner in Melbourne, understanding how to find the most affordable coverage while ensuring comprehensive protection is essential. In this guide, we will walk you through the best strategies to secure the cheapest home insurance in Melbourne without compromising on quality.

Why Affordable Home Insurance Matters in Melbourne

Home insurance plays a crucial role in safeguarding your property against unforeseen circumstances, including natural disasters, accidents, and theft. In Melbourne, where weather conditions can be unpredictable, having reliable coverage that doesn’t break the bank is essential. Many homeowners find themselves caught between selecting affordable options and ensuring that the coverage adequately protects their property. This guide aims to help you strike the perfect balance between cost-efficiency and comprehensive protection.

Homeowners in Melbourne often face specific challenges when selecting an insurance policy, including dealing with rising premiums and the need to navigate complex insurance terms. Whether you are looking for buildings insurance, contents insurance, or combined policies, this article will provide you with practical tips and insights to ensure that you make an informed decision on your next home insurance policy.

Understanding Home Insurance in Melbourne

Before diving into the cheapest options available, it’s important to understand what home insurance covers and what to look for in a policy. Home insurance typically covers two major components:

- Building Insurance: This covers the structure of your home against damage from risks such as fire, storm, flood, or accidental damage. It also covers any fixtures and fittings in your home, including the roof, walls, and floors.

- Contents Insurance: This protects your personal belongings inside the house, such as furniture, electronics, and other valuables. It covers loss or damage due to theft, fire, or other accidents.

Many policies offer a combination of both building and contents insurance. Understanding what each part covers will help you assess your needs and make an informed decision.

Factors Affecting the Cost of Home Insurance in Melbourne

When searching for the cheapest home insurance in Melbourne, you’ll encounter several factors that can influence the price of your premiums. While affordability is key, it’s important to take into account the following:

1. Location

Melbourne is a large city, and different areas have varying levels of risk when it comes to natural disasters, theft, and other factors. For example, properties near the coast or in flood-prone zones may incur higher premiums due to increased risk. In contrast, homes in suburban or low-risk areas may have lower insurance costs.

2. Property Size and Type

The larger and more expensive your property, the more it will cost to insure. This is because larger homes are more expensive to rebuild, and insurance providers will adjust premiums accordingly. Similarly, homes with special features such as swimming pools, expensive roofing, or historical value may see higher premiums due to their increased risk of damage or higher replacement costs.

3. Coverage Limits

The more coverage you need, the more you’ll pay for insurance. If you want to insure the full value of your property, including both building and contents, your premiums will naturally be higher. However, opting for lower coverage limits can help reduce premiums, although this comes with the risk of underinsuring your home.

4. Excess or Deductible

The excess is the amount you agree to pay out of pocket when you make a claim. If you choose a higher excess, your premiums may be lower. However, it’s important to balance this with the potential costs in the event of a claim. Ensure that the excess is an amount you can comfortably afford should the need arise.

5. Claims History and Insurance Provider

Your past claims history plays a role in determining your premiums. If you have a history of making claims, you may face higher premiums. It’s also worth noting that different insurance providers have different pricing strategies and levels of customer service. Shopping around for quotes from multiple providers is essential in securing the best deal.

How to Find the Cheapest Home Insurance in Melbourne

Now that you understand the factors influencing the cost of home insurance, let’s explore practical ways to find the most affordable policies in Melbourne.

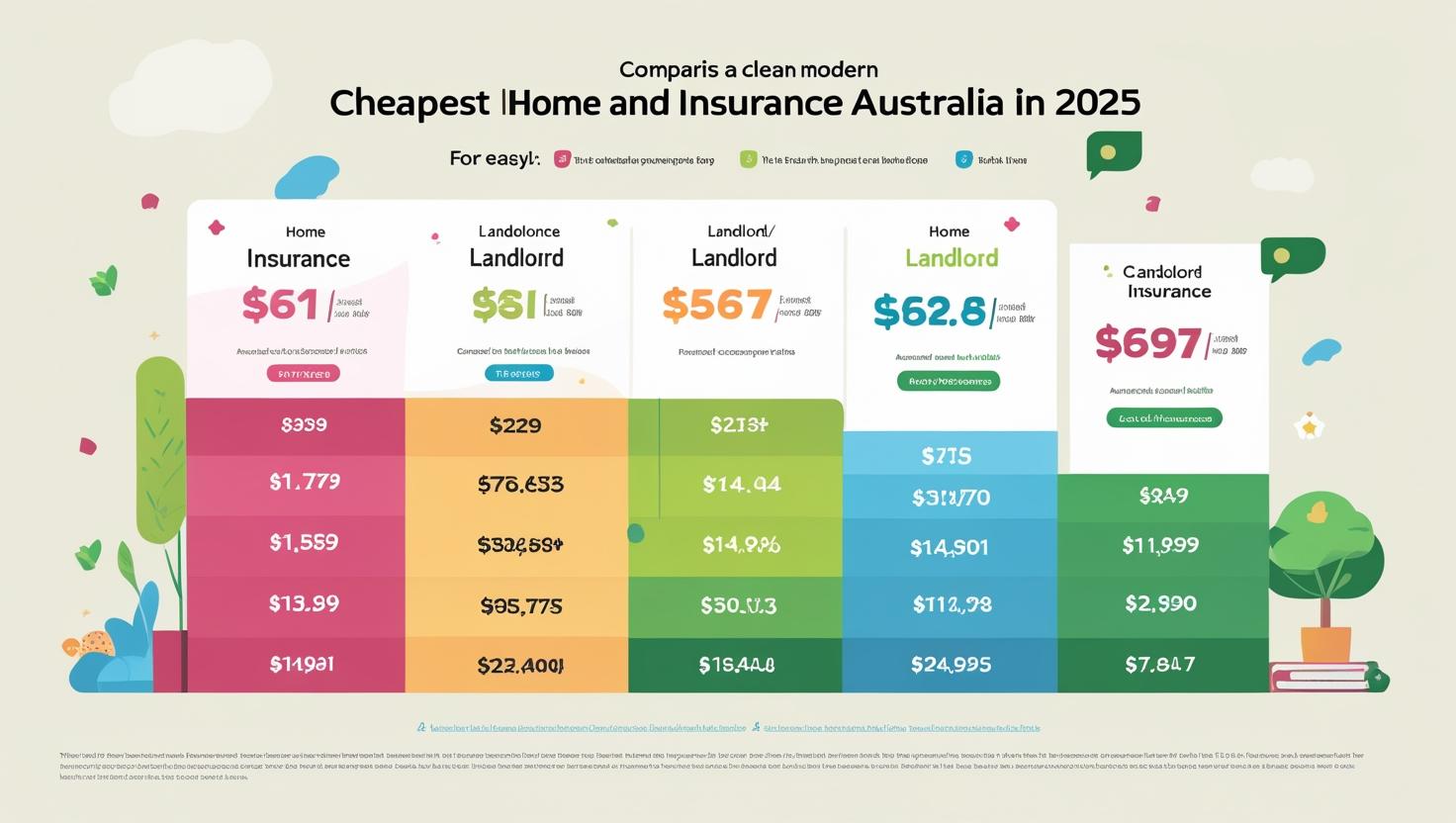

1. Compare Quotes from Multiple Insurers

One of the most effective ways to ensure you’re getting the best deal is to compare quotes from different insurance providers. Online comparison tools allow you to easily compare premiums, coverage options, and excess amounts. Many of these tools are free and can help you identify the cheapest policies that meet your needs. Ensure you compare apples to apples, considering the same coverage levels, excess, and additional features when making your comparisons.

2. Tailor Your Policy to Your Needs

When looking for affordable home insurance, don’t settle for a one-size-fits-all policy. Many providers offer customizable coverage options that allow you to tailor your policy to your specific needs. If you live in a relatively low-risk area and don’t have many high-value items, you may not need a comprehensive or all-inclusive policy. Opt for the coverage that best suits your property’s risk profile and your personal circumstances.

3. Opt for a Higher Excess

As mentioned earlier, increasing your excess can lower your premiums. If you have the financial means to cover a higher excess in the event of a claim, this can be an effective way to reduce your premiums. However, be mindful of choosing an excess that you can comfortably afford, as an unexpectedly high excess could leave you financially vulnerable in case of a claim.

4. Bundle Policies for Discounts

Many insurance companies offer discounts when you bundle multiple policies, such as home and car insurance. If you already have car insurance with a provider, consider adding your home insurance to the same provider to take advantage of potential discounts. Bundling can significantly reduce your overall premium costs.

5. Maintain a Good Claims History

Insurance companies reward policyholders with a history of making few or no claims. By maintaining a good claims history, you may be eligible for no-claim bonuses or discounts. Avoid making small claims, as they could result in higher premiums in the future.

6. Take Advantage of Discounts and Offers

Insurance providers frequently offer promotions and discounts for various reasons, such as installing security systems, being a loyal customer, or paying your premium upfront. Ensure that you inquire about any available discounts when purchasing your policy, as these can further lower your premiums.

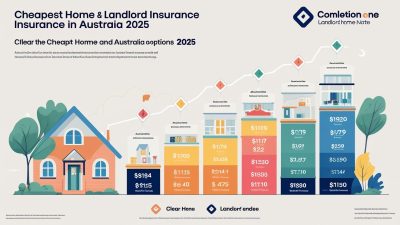

Top Insurers Offering the Cheapest Home Insurance in Melbourne

To help you get started on your search for affordable home insurance, here are some of the top insurance providers in Melbourne known for offering competitive premiums:

1. AAMI Home Insurance

AAMI is one of Australia’s most trusted insurance providers, offering affordable home insurance options with flexible coverage. They provide discounts for combined home and contents policies and offer a range of excess options to help you manage your premiums.

2. Bingle Home Insurance

Bingle offers budget-friendly home insurance policies with a focus on simplicity and convenience. Their policies are designed for those seeking basic coverage at a lower cost, making them ideal for homeowners who want to save on premiums.

3. Allianz Home Insurance

Allianz is a well-established insurer offering both building and contents insurance at competitive rates. They provide various discounts, including multi-policy discounts, and have a reputation for great customer service.

4. Budget Direct Home Insurance

Budget Direct is known for offering affordable insurance options with comprehensive coverage. They have a user-friendly website and offer various excess options to suit different budgets.

5. NRMA Home Insurance

NRMA provides reliable and cost-effective home insurance policies that cater to a wide range of needs. Their policies are flexible, and they offer multi-policy discounts, making them a great choice for homeowners seeking both affordability and quality coverage.

Conclusion

Finding the cheapest home insurance in Melbourne requires careful consideration of your needs, coverage options, and available discounts. By shopping around, comparing quotes, and tailoring your policy, you can secure affordable coverage without compromising on the protection of your home. Remember to keep an eye on your claims history and take advantage of any promotions or discounts offered by insurers. Whether you’re a first-time homeowner or looking to switch providers, following these tips will help you find the best deal for your home insurance in Melbourne.

Start comparing today to secure the most affordable and comprehensive coverage for your property!