Cheapest Home Insurance in Regional Australia: The Ultimate Guide to Affordable Protection

Bloggerbanyumas.com – Home insurance is an essential investment for homeowners across Australia, providing vital coverage against unforeseen events like natural disasters, theft, and accidents. In regional Australia, where properties can be more exposed to various risks, obtaining affordable yet comprehensive home insurance becomes even more crucial. In this detailed guide, we will explore how to find the cheapest home insurance options in regional Australia while ensuring your home is adequately protected.

Home Insurance Challenges in Regional Australia

Homeowners in regional Australia face unique challenges when it comes to securing affordable home insurance. These challenges range from exposure to natural disasters such as bushfires and floods to the difficulty of accessing competitive insurance providers in less populated areas. However, with careful research and strategic planning, homeowners can access affordable insurance policies without compromising on coverage.

This guide will provide in-depth insights into the factors affecting home insurance premiums in regional areas and offer practical steps to help you secure the most cost-effective coverage available.

Key Factors That Affect Home Insurance in Regional Australia

Understanding what influences home insurance premiums is the first step in finding the cheapest option. The following factors play a significant role in determining the cost of home insurance in regional Australia:

1. Location and Risk Factors

In regional Australia, the location of your property significantly influences your insurance premium. Areas prone to specific risks like bushfires, floods, and storms typically attract higher premiums due to the increased likelihood of damage. Homes located in flood zones or near bushfire-prone areas are considered higher risk, leading insurers to increase premiums to cover potential claims.

2. Property Size and Condition

The size, type, and condition of your home also impact insurance costs. Larger properties or those with higher construction costs will require more expensive insurance policies. Additionally, older homes or properties with outdated infrastructure may face higher premiums due to the higher cost of repairs and replacements.

3. Building Materials

The materials used in constructing your home can affect your premiums. For instance, homes made from flammable materials such as timber may incur higher premiums in bushfire-prone areas. On the other hand, homes built with fire-resistant materials, such as brick or concrete, may attract lower premiums in these high-risk zones.

4. Claims History

If you have a history of making insurance claims, your premiums may increase. Insurers view frequent claims as a sign of higher risk, which could lead to higher rates. Maintaining a good claims history is essential in keeping your premiums affordable.

5. Level of Coverage and Excess

The amount of coverage you need and the excess you choose will significantly impact your premiums. A higher level of coverage and lower excess typically result in higher premiums, while a higher excess and lower coverage will reduce your premiums. It’s important to choose the level of coverage that fits your needs without over-insuring or under-insuring your property.

6. Security Features

Properties with security systems such as alarms, CCTV, and deadlocks may be eligible for discounts on home insurance. Insurers view homes with these features as lower risk because they reduce the likelihood of theft or damage.

How to Find the Cheapest Home Insurance in Regional Australia

Finding the cheapest home insurance in regional Australia requires a strategic approach. Below are practical steps to help you find the most affordable coverage:

1. Compare Insurance Quotes from Multiple Providers

One of the most effective ways to find affordable home insurance is to compare quotes from multiple insurance providers. Many online comparison tools allow you to easily compare premiums, coverage options, and excess levels across different providers. By comparing quotes, you can identify the best deal that provides the coverage you need at a price you can afford.

2. Tailor Your Insurance Policy

Rather than opting for a one-size-fits-all insurance policy, tailor your policy to suit your specific needs. If your home is in a low-risk area, you may not need comprehensive coverage that includes protection against events like flooding or bushfires. On the other hand, if you live in a high-risk area, ensure your policy provides adequate coverage for those specific risks.

Tailoring your insurance policy will allow you to exclude unnecessary coverage and reduce your premiums while still ensuring that your property is protected against the risks you are most likely to face.

3. Opt for a Higher Excess

A higher excess is one of the most effective ways to reduce your home insurance premiums. By agreeing to pay a larger amount out of pocket in the event of a claim, you can lower your premium costs. However, ensure that the excess you choose is an amount you can comfortably afford to pay if you need to make a claim.

4. Bundle Your Policies for Discounts

If you have other types of insurance, such as car insurance, consider bundling them with your home insurance policy. Many insurers offer discounts when you take out multiple policies with them, so bundling can lead to significant savings. Check with your insurer to see if they offer this type of discount.

5. Install Security Systems

Installing security features such as alarms, CCTV cameras, and motion sensors can help reduce the risk of theft or damage to your property. Many insurance providers offer discounts to policyholders who have security systems in place, as these features reduce the likelihood of a claim being made. Make sure to inform your insurer about any security upgrades to take advantage of these discounts.

6. Maintain a Good Claims History

Maintaining a good claims history is vital in keeping your premiums low. If you have a history of making few or no claims, insurers are more likely to offer you lower premiums. Avoid making small or unnecessary claims, as this could result in higher premiums when it comes time to renew your policy.

7. Look for Special Discounts and Offers

Many insurers offer special promotions or discounts for new customers or policyholders who meet specific criteria. For instance, some insurers provide discounts for first-time homeowners, for customers who pay their premium upfront, or for those who live in low-risk areas. Make sure to check for any available discounts before finalizing your policy.

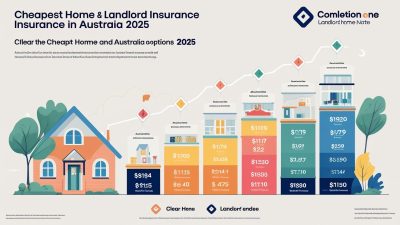

Top Insurers Offering Affordable Home Insurance in Regional Australia

Several insurance providers offer competitive rates for home insurance in regional Australia. Below are some of the top insurers to consider when shopping for affordable home insurance:

1. AAMI Home Insurance

AAMI is a well-known insurer in Australia, offering affordable home insurance with flexible coverage options. They provide discounts for combined home and contents insurance policies and allow you to customize your excess to suit your budget. AAMI is a reliable option for homeowners in regional Australia looking for cost-effective protection.

2. Bingle Home Insurance

Bingle is another budget-friendly insurer that focuses on offering simple and affordable home insurance policies. Their straightforward approach to insurance makes it easy for homeowners in regional areas to secure coverage at an affordable price. Bingle also offers discounts for policies purchased online.

3. Budget Direct Home Insurance

Budget Direct is known for its low-cost insurance options, providing comprehensive coverage at competitive prices. They offer a range of policies for both building and contents insurance, and their online quote system allows for quick and easy comparisons to find the best deal.

4. NRMA Home Insurance

NRMA provides affordable home insurance with flexible options, including the ability to bundle multiple policies for savings. Their policies cover a range of risks, including natural disasters, and they offer discounts for homes with security features.

5. Allianz Home Insurance

Allianz is a trusted insurer in Australia, offering comprehensive home insurance options at competitive prices. Allianz provides various discounts, including no-claim bonuses and multi-policy discounts, making it an excellent choice for homeowners in regional Australia.

Conclusion: Finding the Cheapest Home Insurance in Regional Australia

Finding the cheapest home insurance in regional Australia requires a combination of strategic planning, research, and an understanding of your specific needs. By comparing quotes, customizing your policy, and taking advantage of discounts, you can secure affordable protection for your property. Remember to consider factors such as location, property size, and security features when selecting your coverage.

Start comparing insurance providers today to ensure you get the best deal on home insurance for your property in regional Australia. Whether you live in a bushfire-prone area or a more peaceful rural zone, there’s an affordable policy that can provide the protection you need without breaking the bank.