Cheapest Home Insurance Sydney: A Comprehensive Guide for 2025

Bloggerbanyumas.com – Cheapest Home Insurance Sydney Homeownership in Sydney comes with a set of responsibilities, one of the most important being securing the right home insurance policy. Whether you own a house or a unit, protecting your property from unforeseen risks such as fire, theft, and natural disasters is a top priority. However, finding affordable home insurance that provides adequate coverage without compromising on quality can be a challenging task. In 2025, the insurance market in Sydney is more competitive than ever, with a wide range of policies and providers vying for your attention.

As homeowners become increasingly conscious of rising living costs and economic uncertainty, the demand for cheap home insurance in Sydney continues to grow. In this detailed guide, we will explore how to secure the most affordable home insurance policy in Sydney without sacrificing coverage. We will break down the key factors influencing home insurance premiums, the best strategies for finding affordable options, and the top home insurance providers in Sydney that offer competitive rates.

Understanding the Key Factors Affecting Home Insurance Premiums in Sydney

When searching for the cheapest home insurance in Sydney, it’s essential to understand the various factors that influence the cost of premiums. Insurers use several criteria to assess the risk associated with insuring a property, and these factors directly impact the price you’ll pay for coverage. By being aware of these elements, you can make better decisions about your home insurance needs.

1. Location of the Property

One of the most significant factors affecting the cost of home insurance in Sydney is the location of your property. Areas prone to flooding, bushfires, or high crime rates tend to have higher premiums due to the increased risk of damage or theft. For example, homes in suburbs like Western Sydney, which have higher bushfire risks, may face steeper premiums.

Additionally, homes located in flood-prone areas or near the coast may require extra flood insurance, further increasing the cost of coverage. It’s essential to consider your property’s specific location and assess the associated risks before choosing a policy.

2. The Value of the Property and Contents

The total value of your home and its contents also plays a major role in determining your home insurance premium. More expensive homes or properties with high-value contents will generally attract higher premiums, as insurers need to cover the greater potential financial loss.

If you have a high-value home with premium fixtures and fittings, it is essential to declare the full value of your property and contents to ensure you have adequate coverage. Underestimating your property’s value could leave you underinsured in the event of a claim, while overestimating could unnecessarily increase your premium.

3. Level of Coverage

Home insurance policies typically offer varying levels of coverage. While the most basic policies provide limited protection, more comprehensive policies offer additional coverage for damages to both your property and contents. Comprehensive policies, while offering more extensive protection, are often more expensive.

When comparing home insurance providers in Sydney, it’s important to assess whether a basic policy or a more comprehensive one is best suited to your needs. A cheaper option may sound appealing, but it might not offer the level of protection necessary to cover all potential risks.

4. Excess Amount

The excess is the amount you agree to pay out of pocket in the event of a claim before your insurer covers the rest. Generally, higher excess amounts result in lower premiums, while a lower excess will increase the cost of your insurance.

While it may be tempting to opt for a high excess to reduce your premium, you should ensure that the excess is affordable in the event of a claim. For example, if you set an excess of $1,000, make sure that you can comfortably cover this amount if an incident occurs.

5. Security Features

The security measures you have in place to protect your home can significantly influence the cost of home insurance. Homes with security systems such as alarms, deadlocks, surveillance cameras, and security lighting are seen as lower-risk properties, which can lead to reduced premiums.

If you’re looking for cheap home insurance in Sydney, investing in security features can help reduce your premiums. Not only will this protect your property, but insurers may offer discounts for the installation of security systems.

Strategies to Find the Cheapest Home Insurance in Sydney

Now that we’ve explored the key factors influencing home insurance premiums, let’s discuss the best strategies for finding the most affordable options in Sydney. While price is a critical consideration, it’s also important to ensure that you have sufficient coverage to protect your property and belongings.

1. Use Online Comparison Tools

One of the easiest and most efficient ways to find cheap home insurance in Sydney is to use online comparison tools. These platforms allow you to quickly compare quotes from multiple insurers based on your specific requirements. By entering your details, such as the location of your property, its value, and your preferred level of coverage, you can receive a list of personalized quotes.

Comparison websites such as Compare the Market, iSelect, and Canstar can help you identify affordable policies and narrow down your options. Ensure that the comparison tool you use provides access to a wide range of insurers, as some companies may not appear on all comparison sites.

2. Check for Discounts and Bundles

Many home insurance providers in Sydney offer discounts to attract customers. Some of the most common discounts include:

- No-claims discounts: If you haven’t made any claims in the last few years, you may be eligible for a no-claims discount.

- Bundling discounts: Some insurers offer discounts if you bundle your home insurance with other policies, such as car or life insurance.

- Loyalty discounts: Long-term customers may receive a discount for staying with the same insurer.

When comparing quotes, ask insurers about available discounts and bundle options. Taking advantage of these offers can help you reduce your premium while maintaining adequate coverage.

3. Review Policy Exclusions

While focusing on finding cheap home insurance, it’s essential to thoroughly review the policy’s exclusions. A policy that appears affordable may have exclusions that leave you vulnerable in the event of a claim. Common exclusions include natural disasters like floods and earthquakes, or specific damage to valuable items.

If you live in an area prone to certain risks, such as flooding, ensure that your policy includes coverage for these scenarios. Be prepared to pay a higher premium if you need additional coverage, but the added protection may be worthwhile.

4. Opt for a Higher Excess

As mentioned earlier, choosing a higher excess can significantly lower your premium. If you’re willing to assume more financial responsibility in the event of a claim, increasing your excess is a good strategy to reduce your insurance costs. However, always balance this decision with your ability to pay the excess amount comfortably if necessary.

5. Seek Advice from a Broker

While online comparison tools are a great starting point, working with an insurance broker can provide added benefits. A broker can help you navigate the insurance market, offering expert advice and tailored recommendations based on your needs and budget. Brokers often have access to exclusive deals and can negotiate on your behalf to find the best coverage at the best price.

6. Review Your Policy Annually

Once you’ve secured the cheapest home insurance policy in Sydney, it’s important to review your policy on an annual basis. Your home’s value may change over time, and your insurance needs may evolve. Additionally, insurers often raise premiums each year, so it’s worth comparing quotes annually to ensure that you’re still getting the best deal.

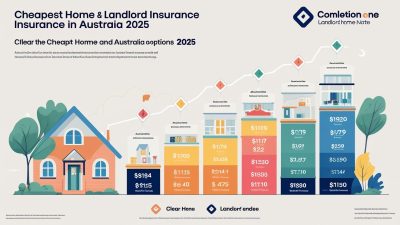

Top Home Insurance Providers in Sydney for 2025

When searching for cheap home insurance in Sydney, it’s important to consider the reputation, reliability, and customer service of the insurer. Below are some of the top home insurance providers in Sydney for 2025 that offer competitive rates without compromising on coverage.

1. AAMI

AAMI is a well-known provider in the Australian insurance market, offering affordable home insurance policies with a range of coverage options. AAMI offers discounts for bundling multiple policies and has a strong reputation for customer service. Their online tools make it easy to compare quotes and select the right policy for your needs.

2. NRMA Insurance

NRMA Insurance is another trusted provider in Sydney, offering comprehensive home insurance with competitive pricing. They provide a variety of discounts, including no-claims and multi-policy discounts. NRMA also offers flexible excess options, allowing customers to tailor their premiums to suit their budgets.

3. Budget Direct

Budget Direct is a popular choice for those seeking affordable home insurance in Sydney. They offer a variety of policies, including coverage for both buildings and contents, as well as combined home and car insurance options. Budget Direct is known for its competitive premiums and no-frills approach to insurance, making it a great option for budget-conscious homeowners.

4. Youi

Youi is an insurer that offers personalized coverage based on individual needs. They provide a range of home insurance policies that can be tailored to suit your requirements, along with competitive premiums. Youi’s flexible coverage options and excellent customer service make it a strong contender in the Sydney home insurance market.

5. Suncorp

Suncorp offers comprehensive home insurance policies that are designed to protect against a wide range of risks. Their policies come with various features, such as coverage for natural disasters, accidental damage, and theft. Suncorp also provides generous discounts for customers who bundle their home and car insurance policies.

Conclusion

Finding the cheapest home insurance in Sydney requires a strategic approach. By understanding the factors that influence home insurance premiums and using the right tools to compare quotes, you can secure a policy that offers both affordability and adequate coverage. Make sure to explore discounts, adjust your excess, and review your policy annually to ensure that you’re getting the best deal.

In 2025, with a wide range of providers offering competitive rates, you can find affordable home insurance that fits your needs without compromising on coverage.