Health Insurance for Overseas Visitors in Australia: Essential Coverage for Your Stay

Bloggerbanyumas.com – Visiting Australia, whether for tourism, business, or family purposes, presents an exciting opportunity to explore a vibrant country with world-class amenities. However, before you pack your bags and embark on your journey, it’s essential to secure appropriate health insurance coverage for your stay. Health insurance for overseas visitors in Australia is not just a necessity but a safeguard to ensure that any medical emergencies or unforeseen health conditions are properly managed, without the fear of incurring excessive costs.

In this comprehensive guide, we delve into the critical elements of health insurance for overseas visitors to Australia. We will outline the benefits of obtaining coverage, factors to consider when selecting a plan, and review the top health insurance providers offering affordable and comprehensive policies for international travelers. Our goal is to provide you with the knowledge to make informed decisions regarding your health insurance needs, so you can enjoy your stay in Australia with peace of mind.

Why Overseas Visitors Need Health Insurance in Australia

Australia’s healthcare system is renowned for its high standard, but as a visitor, you may not have access to the same benefits as Australian residents. The cost of medical treatment in Australia can be substantial, particularly for non-residents. As such, obtaining health insurance is not only a prudent decision but a necessary one to protect yourself financially in case of unexpected illness, injury, or medical emergency.

The Australian Government provides Medicare to its citizens and permanent residents, but overseas visitors are generally not eligible for Medicare coverage unless they come from a country that has a reciprocal healthcare agreement with Australia. Even with this agreement, coverage is limited to essential medical services. For everything beyond that, you will need private health insurance to ensure full coverage for treatment, hospital stays, and emergency services.

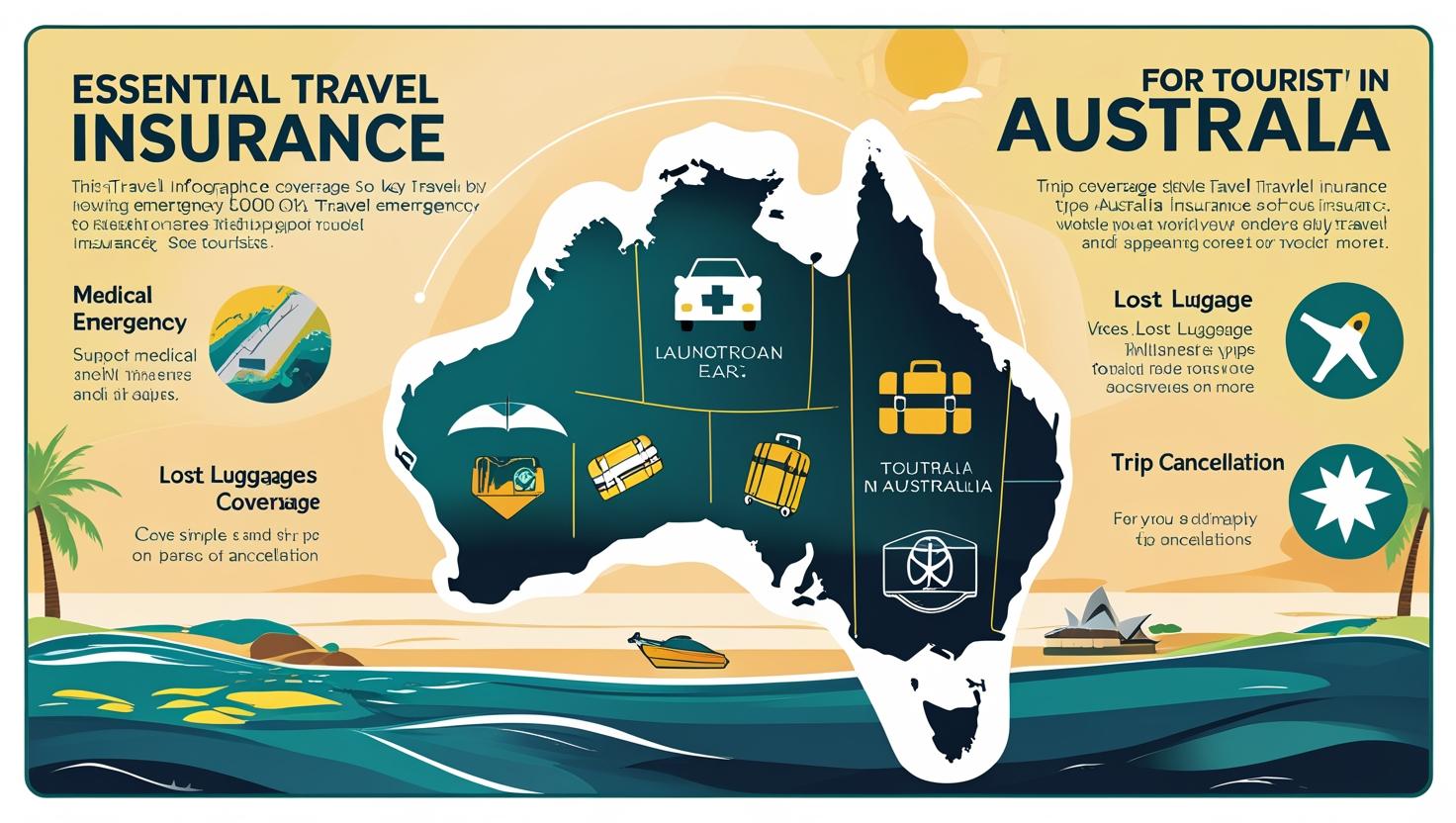

Without insurance, you could face large medical bills for even basic treatment, which may quickly add up in the case of a serious illness or emergency. For example, an ambulance ride in Australia can cost hundreds of dollars, while hospital stays or emergency surgeries can amount to thousands. Therefore, health insurance for overseas visitors is not just a convenience; it’s a vital investment in your health and financial security.

Key Features to Consider When Choosing Health Insurance for Overseas Visitors

When selecting a health insurance plan, it is important to assess the features of each policy carefully to ensure that it meets your specific needs. Here are several crucial elements to consider:

1. Comprehensive Coverage for Medical and Emergency Services

The most important feature of any health insurance policy for overseas visitors is comprehensive medical coverage. Ensure that the plan covers a wide range of medical services, including:

- Hospitalization: Coverage for emergency room visits, surgeries, and hospital stays.

- General Practitioner (GP) Visits: Coverage for regular doctor consultations or visits to medical centers.

- Emergency Medical Evacuation: If you are seriously ill or injured and require transportation to a suitable medical facility, your policy should cover the cost of evacuation.

- Ambulance Services: As mentioned, ambulance services in Australia are expensive, so make sure the plan includes ambulance coverage for emergencies.

- Prescription Medications: Ensure that necessary medications are covered under your policy.

2. Pre-Existing Medical Conditions

If you have pre-existing medical conditions, it’s essential to disclose them when applying for health insurance. Many insurance providers offer plans that cater to individuals with pre-existing conditions, though these plans may come with higher premiums or specific exclusions. Make sure to review the policy details regarding coverage for pre-existing conditions to avoid unexpected costs.

3. Limitations and Exclusions

Every insurance policy comes with limitations, exclusions, and terms. It’s critical to understand the scope of your coverage, including any activities or scenarios that may not be covered by your policy. Some common exclusions include:

- Adventure Sports: Activities such as skiing, bungee jumping, or scuba diving may not be covered, unless specifically included in the policy.

- Non-Essential Treatments: Elective surgeries, cosmetic procedures, and treatments that are not deemed urgent or necessary may be excluded.

- Alcohol or Drug Use: Some policies exclude coverage for injuries or illnesses caused by alcohol or drug consumption.

Before finalizing a policy, make sure you fully understand these exclusions to avoid surprises when making a claim.

4. Claims Process and Customer Support

An efficient and straightforward claims process is essential, especially in an emergency. Check if the insurer provides 24/7 customer support and a clear, easy-to-navigate claims process. Read customer reviews and testimonials to gauge the insurer’s reputation for handling claims quickly and fairly. The ability to quickly access assistance when needed can make a significant difference during a medical emergency.

5. Price and Deductible Options

Cost is always a significant consideration when purchasing health insurance. While it’s tempting to choose the cheapest option, it’s essential to balance affordability with coverage. Higher premiums often come with lower deductibles and broader coverage, while lower premiums may result in higher deductibles or more limited coverage. Choose a policy that suits both your budget and health needs.

Additionally, many insurance policies offer various levels of excess or deductible amounts. This is the amount you must pay out of pocket before the insurance provider begins to cover the costs. Opting for a higher deductible can reduce your premiums, but ensure that you are comfortable with the out-of-pocket cost in the event of a claim.

Top Health Insurance Providers for Overseas Visitors in Australia

Several reputable health insurance companies in Australia offer specialized plans for overseas visitors. Below is a list of some of the leading providers:

1. Medibank Private

Medibank is one of Australia’s largest private health insurers, providing comprehensive coverage for overseas visitors. Their health insurance plans include cover for hospital treatments, emergency services, medical consultations, and more. Medibank also offers a range of flexible policies, allowing you to customize your coverage according to your specific needs. With 24/7 customer support and a straightforward claims process, Medibank is a reliable choice for international travelers.

2. Bupa Australia

Bupa is a global healthcare provider with a strong presence in Australia. They offer visitor health insurance plans that cover a range of services, including medical treatment, hospital stays, and emergency services. Bupa’s policies also provide access to an extensive network of healthcare providers across Australia, making it convenient for visitors to find a medical professional when needed. Their flexible policies allow visitors to select the level of coverage that suits their needs and budget.

3. Allianz Global Assistance

Allianz Global Assistance offers comprehensive travel and health insurance plans for overseas visitors to Australia. Their policies cover emergency medical treatments, hospitalization, and evacuation services, among other benefits. Allianz is known for its customer-centric approach, providing easy access to support and claims processing when needed. The insurer also offers additional coverage for trip cancellations and travel delays, ensuring that visitors are protected against unexpected disruptions.

4. NIB Health Funds

NIB offers a range of visitor health insurance plans tailored to international travelers. Their policies cover hospital stays, medical treatments, ambulance services, and more. NIB provides straightforward and affordable options with flexible coverage limits, making it easier for visitors to select a plan that fits their needs. Their online platform makes it simple to access information, make claims, and receive support throughout your stay in Australia.

5. HCF

HCF is a trusted Australian health insurance provider offering visitor health insurance plans that cover essential medical and emergency services. Their policies are known for their transparency and ease of use, with a claims process that is both simple and efficient. HCF also offers added benefits, such as coverage for non-emergency medical services and access to a wide network of healthcare providers.

How to Save on Health Insurance for Overseas Visitors

While securing comprehensive health insurance is essential, there are several ways to reduce the cost without compromising on coverage. Here are some tips to save on your health insurance premiums:

1. Compare Multiple Providers

Use comparison websites to evaluate different health insurance plans and providers. By comparing coverage, premiums, and features, you can select the best policy that offers the most value for your money.

2. Opt for a Higher Excess

Choosing a higher deductible or excess can help reduce the premium cost of your health insurance. While this means you will pay more out of pocket in the event of a claim, it can significantly lower your overall premium.

3. Choose a Basic Plan

If you are only staying in Australia for a short period and anticipate minimal medical needs, consider opting for a basic health insurance plan. These plans usually cover emergency medical treatments, hospital stays, and essential services, but they may exclude non-urgent care or elective treatments.

4. Look for Special Offers or Discounts

Many health insurance providers offer discounts or special deals for visitors. These may include group discounts, early booking discounts, or offers for specific types of travelers, such as students or senior citizens. Always ask about available discounts when purchasing your policy.

Conclusion

Health insurance for overseas visitors in Australia is an essential component of your travel plans. Whether you’re visiting for leisure, business, or a longer stay, securing appropriate health insurance ensures that you are covered in case of medical emergencies or unforeseen health issues. By carefully considering your health needs, comparing policies, and selecting a reliable provider, you can find the right plan that offers comprehensive coverage at an affordable price.

Make sure to explore all available options, understand the terms of each policy, and choose the coverage that best fits your budget and travel requirements. With the right health insurance, you can enjoy your time in Australia without the worry of unexpected medical costs. Stay safe, stay covered, and make the most of your Australian adventure.