Home Insurance for Specific Risks in Australia: A Detailed Guide for 2025

Bloggerbanyumas.com – When it comes to protecting your home, a standard home insurance policy may not always offer sufficient coverage for specific risks that could affect your property. In Australia, where natural disasters like bushfires, floods, and cyclones are prevalent, it’s essential to tailor your home insurance to suit the unique risks that your home may face. A one-size-fits-all insurance policy might leave gaps in your coverage, leaving you financially vulnerable in the event of a major incident.

As homeowners become more aware of the increasing frequency and severity of natural disasters and other risks, specialized home insurance options that cover specific risks are growing in importance. This guide will explore how you can protect your property from these specific risks with the right home insurance policy, and what to look for when choosing the best coverage to suit your needs.

Why Specific Risks Matter in Home Insurance

Australia’s diverse climate and geographic conditions mean that homeowners face a range of unique risks. Whether you’re living in an area prone to bushfires in New South Wales or a flood zone in Queensland, the specific risks that your property faces should be a key consideration when choosing home insurance. By opting for policies designed to cover these risks, you ensure that you have the necessary protection in place to deal with potential threats.

In 2025, the understanding of what constitutes a high-risk home has expanded beyond the traditional hazards of fire and theft. The rise of climate-related events, the increasing intensity of storms, and the possibility of new risks, like hail and storm surge, make it crucial to look for home insurance policies that can cover a wider range of threats. Here’s a breakdown of why and how specific risks are being covered in today’s home insurance market.

Common Specific Risks Covered by Home Insurance in Australia

1. Bushfire Insurance

Bushfires are one of the most significant risks in Australia, particularly in areas like New South Wales, Victoria, and parts of South Australia. The devastating fires of 2019-2020 brought the need for proper bushfire insurance coverage to the forefront. Insuring against bushfire damage goes beyond just having a standard home insurance policy—it requires tailored coverage that accounts for the high risk of wildfires in certain parts of the country.

Bushfire coverage typically includes protection for structural damage caused by fire, as well as coverage for smoke damage and damage caused by the firefighting process (such as water or foam damage). It’s essential to note that some insurers may place exclusions on properties located in high-risk areas or charge higher premiums for coverage in bushfire zones. Homeowners living in fire-prone areas should always check that their policy includes specific bushfire protection.

2. Flood Insurance

Flooding is another risk that many Australians face, especially those living near coastlines or inland rivers. In the aftermath of catastrophic floods in Queensland and New South Wales in recent years, flood coverage has become a critical aspect of home insurance. Flood insurance covers water damage caused by the overflow of rivers, creeks, or other water bodies, as well as flash floods resulting from heavy rainfall.

While home insurance policies may cover damage caused by water from broken pipes or leaking roofs, flood insurance specifically addresses the risks posed by large-scale water events. Many standard home insurance policies in Australia exclude flood damage unless specifically included, so it is essential for homeowners in flood-prone areas to opt for additional flood coverage. Insurers may offer flood coverage as an optional add-on or as a standard feature for properties in flood-prone areas.

3. Storm and Hail Damage Insurance

Australia is no stranger to severe storms, and hailstorms in particular have caused widespread damage in various regions, including Melbourne, Sydney, and Brisbane. Hailstorms can damage roofs, windows, vehicles, and outdoor structures. As storm activity continues to intensify with the effects of climate change, it’s crucial to have a home insurance policy that specifically covers storm and hail damage.

Storm insurance typically covers damage caused by heavy winds, rain, hail, and even lightning strikes. A good storm and hail coverage will include damage to your home’s structure as well as damage to your personal belongings, such as furniture or electronics, that are affected by the storm. This coverage is typically included in comprehensive home insurance policies but can be excluded or limited in more basic plans.

4. Cyclone Insurance

Cyclones, also known as tropical storms or hurricanes, pose a significant risk to homeowners in northern parts of Australia, including Queensland, the Northern Territory, and parts of Western Australia. These storms bring heavy winds, flooding, and storm surges that can cause severe damage to homes and other structures.

Cyclone insurance is often included under storm and hail damage coverage, but specific provisions may apply depending on the insurer. This coverage can include damage caused by high winds, flying debris, storm surge, and flooding. Cyclone-prone areas often have higher premiums due to the increased risk, so it is crucial to confirm that your policy provides adequate protection for cyclones if you live in an affected region.

5. Theft and Vandalism Insurance

While theft and vandalism are generally covered under standard home insurance policies, homeowners should ensure that they have adequate protection for these specific risks. In urban areas where break-ins and property damage are more common, specific theft and vandalism coverage can help protect both the structure of your home and your personal belongings.

In areas with higher crime rates, insurers may increase premiums or offer additional coverage options for theft and vandalism. It’s important to review your home insurance policy and ensure that the coverage is robust enough to cover the potential costs of repairs or replacement of stolen or damaged property.

6. Landslide and Earthquake Insurance

While landslides and earthquakes are not as common as other natural disasters in Australia, certain areas are more susceptible to these risks, particularly in parts of New South Wales, Victoria, and Tasmania. Landslides can occur due to heavy rains or seismic activity, potentially causing significant damage to homes situated on unstable land.

Homeowners in high-risk areas should confirm whether their home insurance includes coverage for these types of disasters. Earthquake insurance is not always automatically included in standard home insurance policies, so it is essential to request this as an add-on or select a policy that provides this type of coverage.

7. Fire and Smoke Damage Coverage

Apart from bushfires, residential properties can also be exposed to fire risks from other sources, including electrical faults, kitchen fires, or other accidents. Smoke damage, even without direct fire damage, can also be costly to repair and clean. Specialized fire and smoke coverage are vital in these cases to ensure that you’re covered against both direct fire damage and secondary smoke damage.

This coverage is typically included in comprehensive policies but may not be available in basic policies. In regions with higher fire risks, additional coverage options may be offered by insurers to ensure homeowners are adequately protected.

How to Select Home Insurance for Specific Risks

1. Identify Your Home’s Risks

The first step in selecting home insurance for specific risks is identifying the risks your home faces. Take into account the location of your property, the potential for natural disasters, and the value of your home and contents. If your home is situated in a high-risk area for bushfires, floods, or storms, you will need additional coverage to protect against these threats.

Consider the historical patterns of disasters in your area. If your home is in a flood zone, check flood insurance options even if there has been no recent flooding. Your insurance policy should reflect the potential risks that could affect your home.

2. Review Your Policy Options

Once you’ve identified the risks, research the available home insurance policies that cover those specific threats. Standard home insurance policies may cover some risks, such as storm and fire damage, but may not include more specific protections like flood, landslide, or earthquake coverage. Ensure that the policy you choose includes the risks specific to your property.

Ask your insurer about adding specific riders or endorsements to your policy. These can be added to customize your coverage based on the risks in your area. For example, if you live in an area prone to flooding, inquire whether flood insurance is an optional add-on or included in your policy.

3. Compare Insurance Providers

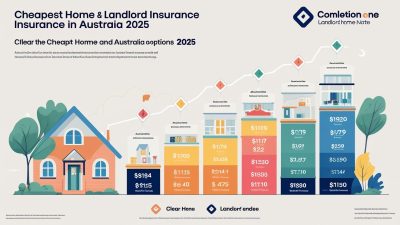

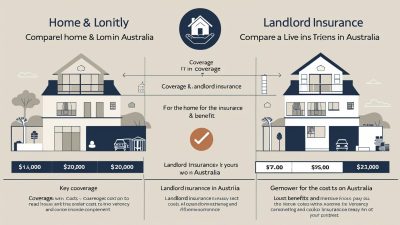

When looking for home insurance that covers specific risks, it’s essential to compare providers. Not all insurers offer the same level of coverage for natural disasters, and the pricing can vary greatly depending on the provider and the region in which you live. Use online comparison tools, such as Canstar or Compare the Market, to evaluate multiple policies and determine which one provides the most comprehensive coverage for your needs at the best price.

4. Consider Premiums and Deductibles

While specialized coverage is crucial, it’s important to balance premium costs and deductibles. Higher coverage may mean higher premiums, but you want to ensure that the cost of your premium aligns with the level of coverage you need. In some cases, increasing your deductible can lower your premium, but be sure that you can afford to pay the deductible in the event of a claim.

Conclusion

Home insurance in Australia is essential for protecting your property against the various risks that can cause financial devastation. Whether it’s bushfires, floods, cyclones, or theft, ensuring that your policy covers the specific risks associated with your home is vital. Tailored home insurance for specific risks offers peace of mind, knowing that you have comprehensive protection against the unique threats your property faces.

In 2025, the variety of home insurance policies available ensures that homeowners can find coverage that suits their specific needs, whether they live in a bushfire-prone area, a flood zone, or a region affected by severe storms. By identifying the risks, reviewing your policy options, and comparing providers, you can secure the best home insurance to protect your home from a variety of threats, ensuring peace of mind for years to come.