How Often Should I Compare Home Insurance in Australia?

Bloggerbanyumas.com – How Often Should I Compare Home Insurance in Australia When it comes to home insurance in Australia, securing the right coverage is only part of the equation. Ensuring that you’re consistently getting the best deal for your home insurance is just as important, especially as rates and policy offerings frequently change. Many Australians are often uncertain about how frequently they should compare their home insurance options. Given the volatile nature of the insurance market, the rise in natural disasters, and changes in personal circumstances, regularly comparing home insurance policies is a vital step in securing financial protection for your home at the best possible price.

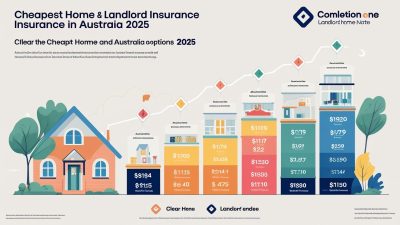

In 2025, as insurers introduce new policies, adjust premiums, and offer unique benefits, homeowners in Australia have a broader range of choices than ever before. With this competitive landscape, it becomes essential to evaluate how often you should revisit your insurance policy. This comprehensive guide delves into the factors that influence your decision to compare home insurance, the benefits of regular comparisons, and the strategies you can employ to ensure that you are getting the best value for your money.

The Need for Regular Home Insurance Comparisons

The home insurance market in Australia is dynamic and constantly evolving. Whether due to changes in the insurance landscape, fluctuations in your personal circumstances, or new offerings from providers, there are several reasons why comparing home insurance regularly is necessary. While many homeowners choose to renew their policies without much thought, this approach can result in paying higher premiums or being inadequately covered for emerging risks.

In an increasingly digital world, insurance comparison tools have made the process easier than ever. Homeowners now have the opportunity to evaluate multiple providers and coverage options quickly and efficiently. But how often should this process take place to ensure that you’re not overpaying or leaving gaps in your coverage?

1. Changes in Personal Circumstances

Personal changes, such as purchasing new valuables, remodeling your home, or moving to a new location, can significantly impact your home insurance needs. For example, if you’ve made improvements to your property, such as adding a new pool, extension, or high-value appliances, you may need to update your coverage to reflect the increased value of your home and contents. Failing to adjust your policy accordingly can leave you underinsured.

Additionally, changes in your household, such as getting married, starting a family, or having adult children move out, can also affect your insurance needs. Each life event can alter the risks associated with your property, and by regularly comparing home insurance options, you ensure that you have the most appropriate policy for your situation.

2. Changes in the Insurance Market

The home insurance market in Australia is highly competitive, with insurers constantly revising their pricing models, adjusting premiums, and introducing new products. Insurance companies may offer discounted rates, promotional deals, or introduce new add-ons to attract new customers. If you’ve been with the same provider for years, there’s a chance that their rates have increased or that there are more cost-effective options available from other insurers.

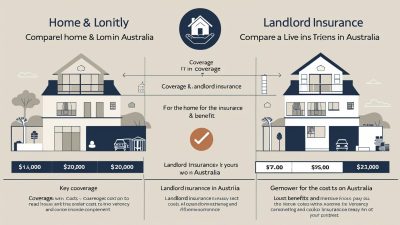

Insurance comparison websites, such as Compare the Market, iSelect, and Canstar, make it easier to stay updated on market shifts. These platforms provide comparisons from various insurers, helping you identify better deals that meet your coverage needs at a lower cost. Providers also tend to offer loyalty or multi-policy discounts, so switching providers or bundling your home insurance with other policies, like car or life insurance, can reduce overall costs.

3. Adjusting to Natural Disaster Risks

Australia faces a wide range of natural disasters, including bushfires, floods, cyclones, and storms. With climate change influencing weather patterns, the frequency and severity of these events have been increasing. Consequently, the risks associated with your home may evolve, requiring adjustments to your insurance coverage. Areas previously not prone to bushfires or flooding are seeing an uptick in these risks, and as a result, insurers are revising their policies.

For instance, in areas affected by recent bushfires or floods, home insurance premiums may rise to reflect the heightened risk. At the same time, insurers may exclude specific coverage for events like floods unless explicitly included in the policy. By regularly comparing home insurance, you can ensure your policy is up to date and appropriately covers your home against emerging risks.

When Should You Compare Home Insurance in Australia?

Now that we’ve discussed the importance of regularly comparing home insurance, let’s break down how often you should consider reassessing your policy. While there is no one-size-fits-all answer, certain events and circumstances indicate the need for a more frequent review.

1. Annually

The most common frequency for comparing home insurance is on an annual basis. Insurance providers often adjust premiums and coverage options yearly. At policy renewal time, you’ll receive a renewal notice from your insurer detailing your current premiums, coverage levels, and any changes to the terms of the policy. This is the ideal time to compare your current insurer with others in the market.

Even if your renewal premium is lower than the previous year, it’s important to verify whether your coverage is still adequate for your home’s needs. For example, you may have acquired new assets or made renovations that increase the overall value of your home. If your home insurance doesn’t account for these changes, you could be leaving yourself vulnerable in the event of a claim.

2. After Significant Life Events

Certain life events trigger the need to reassess your home insurance policy. Examples include:

- Buying or Selling a Property: When you purchase a new home or sell an old one, it’s crucial to update your home insurance to reflect the value and condition of the property. A new home may come with unique risks that require specific coverage.

- Renovations and Extensions: If you’ve made significant changes to your home, such as adding a new room or upgrading your kitchen, your insurance needs will likely change. A major renovation or extension can increase the value of your property, and you’ll need to update your policy to ensure full coverage.

- Changes in Family Circumstances: Moving in with a partner, having children, or even becoming empty nesters can impact the types of coverage you require. For instance, you might want to increase contents coverage if you’ve acquired valuable items or reduce coverage if fewer people live in the home.

In these instances, reviewing and comparing home insurance policies will help ensure that your coverage matches your evolving needs.

3. Following a Natural Disaster or Major Event

If your area is affected by a natural disaster, such as a flood or bushfire, it’s essential to review your home insurance policy immediately. Post-disaster, many insurers re-evaluate their pricing models and coverage for specific events. For example, if you live in a region recently affected by a bushfire, your insurer may adjust your premiums or change the level of coverage for future fire damage.

Natural disasters often prompt homeowners to review their policy and determine if they have sufficient coverage for the specific risks they face. In some cases, insurers may introduce new exclusions or impose higher premiums to account for the increased risk. It’s always a good idea to compare policies from different providers to ensure your coverage remains adequate.

4. Changes in Insurance Laws or Regulations

In Australia, home insurance policies are also affected by changes in laws and regulations. These can include changes in tax laws, building codes, or regulations regarding flood insurance. Insurers must comply with any new legislative requirements, which could impact your home insurance policy.

It’s important to stay informed about such changes, as they can directly affect your coverage and premium. By comparing home insurance regularly, you can ensure that you’re aware of any new regulations and ensure that your insurance policy complies with them.

Strategies for Effectively Comparing Home Insurance in Australia

When it comes time to compare home insurance, a structured approach will help you make informed decisions. Here are some strategies to keep in mind:

1. Use Insurance Comparison Websites

Utilizing comparison tools like Compare the Market, iSelect, and Canstar allows you to easily compare various policies from different providers. These platforms provide an overview of premiums, coverage options, and excess amounts to help you make a side-by-side comparison. By inputting your details once, you can get multiple quotes and determine which insurer offers the best coverage for your needs.

2. Evaluate Policy Inclusions and Exclusions

When comparing quotes, don’t just look at the premium price. Evaluate what is included and excluded in each policy. Some policies may have extensive coverage options, such as accidental damage, while others may offer more basic protection. Pay attention to exclusions, such as specific risks that may be excluded or require additional coverage, such as floods or earthquakes.

3. Consider Excess and Discounts

The excess you choose plays a significant role in determining your premium. A higher excess typically results in lower premiums, but it’s important to choose an amount you can afford to pay in the event of a claim. Also, check if there are any discounts available, such as no-claims bonuses or multi-policy discounts, which can reduce the overall cost of your insurance.

4. Review Customer Service and Claims Process

When selecting an insurer, customer service is crucial. Look for insurers with a strong reputation for handling claims efficiently and providing good customer support. Reading customer reviews and checking ratings from third-party review sites can help you identify providers with a track record of excellent service.

Conclusion

In Australia, regularly comparing home insurance is essential to ensure you are getting the best value for your money and the coverage you need. While an annual review is recommended, significant life events, changes in the insurance market, or emerging risks may necessitate more frequent comparisons. By using comparison tools, evaluating policy inclusions and exclusions, and considering changes in personal circumstances, you can secure affordable and comprehensive coverage for your home.

In 2025, the home insurance landscape in Australia is dynamic, and staying on top of these changes through regular comparisons will help you make informed decisions, ensuring that you are always protected without overpaying.